However, when President Trump enacted the Tax Cuts and Jobs Act, he raised something called the standard deduction. When you file taxes, you will notice a $240 deduction. What does this mean? Let’s say, for example, you qualify for a $1,000 tax deduction and fall under the 24 percent tax bracket. On the other hand, tax deductions lower your annual taxable income.

So, if you owe $5,000 in taxes and receive the $2,000 Child Tax Credit, you will only have to pay $3,000 in taxes. For example, if you qualify for the Child Tax Credit, the $2,000 tax credit (if you have one qualifying child), will be taken out of your taxes. This tax incentive is subtracted from your total tax liability, not your annual taxable income. A tax credit reduces the amount of taxes you owe for the year, dollar for dollar.

The Internal Revenue Service (IRS) offers relief to taxpayers in three ways: tax credits and tax deductions, as well as exemptions.

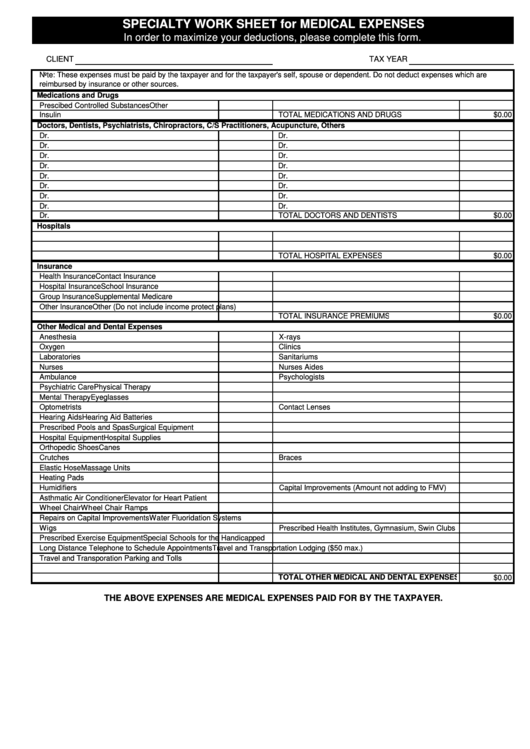

Key takeaways on medical expense deductionsīefore diving into which medical expenses are tax deductible, you first need to know what tax deductions are in the first place. Are there any tax credits to help with medical expenses?. How do I deduct medical expenses on my tax return?. What medical expenses are not tax deductible?. What medical expenses are tax deductible?. Or, use the jump links to navigate to a section that may answer a question you have. If you’re looking for an in-depth explanation on which medical expenses are tax deductible, continue reading below. In order to reap all of the benefits medical tax deductions have to offer, you first need to know what medical expenses are deductible and which ones are not. If you’re an American dealing with a mountainous medical bill, you can take advantage of tax deductions. And, the Kaiser Family Foundation and The New York Times Medical Bill Survey found that 26 percent of Americans aged 18-64 had difficulty paying their medical bills. Researchers from Johns Hopkins Bloomberg School of Public Health found that of all the developed countries, Americans face the highest medical prices, spending roughly $9,892 on medical expenses per year-108 percent higher than what neighboring Canadians pay per year. It’s not a myth that America has some of the most expensive health care coverage in the world.

0 kommentar(er)

0 kommentar(er)